So it just hit the news that two of the founders of the ridiculously fast-growing start-up Groupon ($0 to $6B in two years) have invested in a newly emerging space – local vendors offering quotes on retail services like plumbing, mechanics, delivery, etc. They just gave Openchime $700,000 and it works like this –

Local retailers sign up for the website by describing their service offerings. Customers looking on their site for, say a handyman, would list their needs and receive quotes from the local small business owners.

Will this business model really help small business owners pick up additional customers? Right now it’s free, but I can see a future where they charge local vendors per quote or per month if it takes off. Apparently, some very smart people think so, but in case you wanted to test drive them yourself, I’ve tried the three top websites in this space, Openchime, Red Beacon and Thumbtack here for your review.

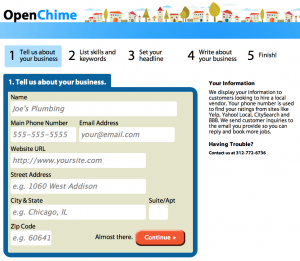

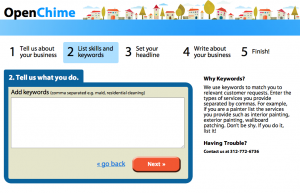

Openchime (2.5 stars)

What I like:

Offers an easy to sign up interface and explains the importance of keywords in the vendor description (i.e. use keywords you think customers would type into Google when describing your business on Openchime).

Be sure to insert “keywords” into the description of your business listing.

Inserting keywords into the title of your business listing is even more critical.

You’re almost done!

What I don’t like –

They didn’t offer me an instant email with a link to see what my profile would look like, only that

“Your Listing is Awaiting Approval.”

Bummer user experience for the first time merchant who is curious to see what the information they just supplied looks like. Teenagers aren’t the only ones who want instant gratification anymore.

Another negative is to have to click 4 mouse-clicks to finish a profile page.

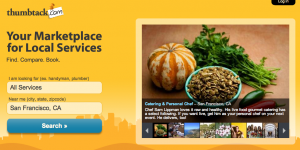

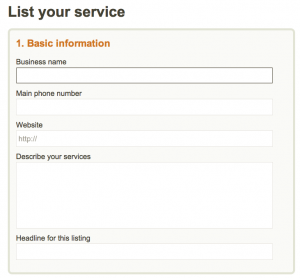

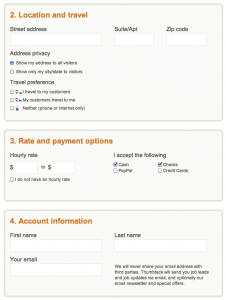

Thumbtack (2.25 stars)

What I like –

Their signup process for local merchants is effortless and resides mostly on a single page you have to scroll down through to complete. Their signup process doesn’t emphasize the importance of inserting keywords into the title description of your local business or the description – but it is equally beneficial here as well.

They also claim they have an “automated listing on Craigslist.” Really? I thought this was against Craigslist’s terms of use?

Don’t forget those keywords…

What I don’t like –

Again, the lack of even an email confirmation from someone I just gave potentially sensitive information to dilutes my initial enthusiasm for their user experience.

Red Beacon (2.0 stars)

What I like – Honestly, not much. Their sign-up process is somewhat muted. But at least they have video testimonials (yawn).

What I don’t like –

The design seems like someone got mentally lazy and picked some orbital figures from istockphoto.com. Also, their transactions and reviews seem either fake or out-dated. Not saying that they are, just that they seem, let’s just say – quirky.

Here’s what the profile page of local merchants looks like in Red Beacon. BTW I found this by taking a name from one of their testimonials and Googling the person, since Red Beacon’s own website doesn’t have an easy to use search function.

The verdict –

It remains to be seen whether consumers will flock to a model like this, but if these are the top three, there’s a bit more room to improve. A bit, bit more.