There’s one terror out there plaguing most entrepreneurs and small businesses, a terror that could shatter all auto attendants and call centers into oblivion, leaving nothing in its wake.

It’s called…. Tax time!

Where Are You Going With This?

I’m glad you asked that. Obviously, there’s a reason why this is going to be about tax time. What’s the big deal? We thought this was a small business blog! And that’s what interests entrepreneurs all over the world — the latest stuff on small businesses.

What Taxes Mean to the Everyday Entrepreneur

Pain and suffering. That’s what it really boils down to. But why?

Think about it: you’re an entrepreneur. That means you’re your own boss. That also means you pay a tax for your business and for yourself as an individual. It’s not like you’re getting your taxes taken out of any W2’s you might have.

In addition, that also means any expenses you have that go toward your business need to be itemized, written off, and checked in with your taxes. Frequent flyer miles? You bet. That stuff goes in your taxes, too. Do you have to drive? If so, you better be writing down every single mile you drive for the sake of your business.

So Much Work for the Entrepreneur

Needless to say, that’s a lot of tedious work. And it’s work that needs to be done if you want to maximize any kind of return you might get in your taxes.

Tracking everything financially as an entrepreneur means everything to your business.

Which Brings You, the Entrepreneur, to This:

And now the Google Apps Marketplace has you covered with the most comprehensive and easy app to sync just about anything and everything financial in your company.

Introducing Expensify

Rating: 4 1/2 out of 5 stars

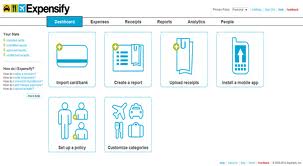

Imagine an app you can use on a computer, on a tablet — dare I say, even on a smartphone — that can literally handle everything?

Expensify does just that.

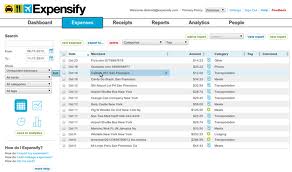

Starting with all business expenses, all it takes is a press of a button to sync your credit card or bank account with the app and pull your expenses in, logging every single dollar, so you can see straight away what you’re dealing with in terms of money. In addition, Expensify logs all mileage expenses for you and can even set guidelines to automate spending.

It’s Like Having a Person Accountant Go With You

And don’t you just hate having to save receipts and receipts of any expenses you may incur? That’s a lot of crappy paper to hold onto. Enter: the ever-handy “eReceipt,” an immediate file logged into your unlimited storage database from within the app, viewable on your computer, tablet, or smartphone.

Yes, you heard me: unlimited. Imagine paying for things with your credit card and then having Expensify sync all those purchases with an immediate eReceipt transfer into your files.

Imagine tax time and having the easiest ordeal on your hands. Simply print everything off, and you’re good to go.

You can also set up financial reports synchronizing with direct deposits toward any employees you might have, not to mention deep integration with the popular QuickBooks.

Forget hiring an accountant — you’ve got Expensify!

But Maybe You Hate Working With Numbers Like That

That is, of course, why you hire an accountant. So maybe Expensify wouldn’t help you much. It all depends on what you prefer as a businessperson.

Some like to see the numbers and know that everything’s okay; some really don’t care as long as it’s handled. And the reality is another app will just take up space in your computer, tablet, or smartphone memory.

Some like to see the numbers and know that everything’s okay; some really don’t care as long as it’s handled. And the reality is another app will just take up space in your computer, tablet, or smartphone memory.

If you’ve got the dough to spend from your bottom line, you may save yourself some of the time in managing your finances by hiring someone else to do it!

Of course, that’s just my opinion — I could be wrong. As the infamous Dennis Miller would say.

So Don’t Be Afraid of Tax Time

There are ways to handle it if you’re an entrepreneur. Certainly Expensify can make it a little easier for you.

As Benjamin Franklin would say: “in this world, nothing can be said to be certain, except death and taxes.”

Well, I think we’ve got the ‘taxes’ thing figured out!

(Now all we’ve got to do is get past the whole death thing.)

Related Keywords: finance department, payroll, benefits