Lots of people out there use the mobile payment service Paypal. In fact, there’s a pretty fair chance that you’re one of them. That’s how many Paypal users there are out there. But if you’re not a Paypal user, or you’re not using it for small business, you may want to reconsider, because there are so many potential benefits that your small business can use that one of them almost certainly falls into place.

Using the Paypal service in general provides a lot of benefits. Not only can you use it to pay your employees, as well as manage some of your accounts payable and accounts receivable, but there are also plenty of accounting benefits, like preparing an easy to read and use expense report for your tax preparation. I’ve actually used Paypal for quite some time myself.

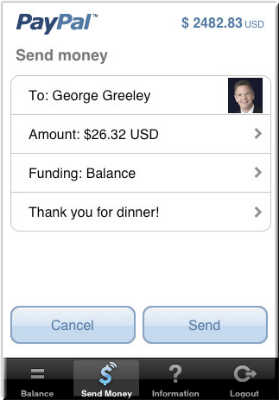

The mobile version, meanwhile, offers much the same capability–the ability to pay some bills remotely, for one–but really only revolves around buying things. Accepting money through Paypal Mobile is possible, but usually requires someone else to have a Paypal Mobile account, so it’s not really as versatile as, say, Square, that will take credit cards and even offer a dongle to accomplish this task. The iPhone version, though, will let you take a photo of a check and process it, though it does take five to six days to run the check through and the check itself may be returned, so it’s, again, really not as versatile or efficient as Square would be.

Still though, there’s a fair chance you’ll get a lot of use out of Paypal Mobile. It can collect payments, if not as efficiently as some, and it can make payments, again, not so efficiently. Accounts payable will likely be enamored with this app; accounts receivable, not so much.

Related keywords: mobile payment processor, accounts receivable, mobile device, checks